Purchase invoice

In purchase registration invoices from suppliers are registered, the stock system updated if company has subscription for sale and stock system, and the invoice booked in the accounting system if company has subscription for the accounting system.

By selecting the appropriate tab already registered invoices can be viewed and also view and select kept registrations.

Received eCommerce invoices are automatically imported to purchase registration and can be selected and copied to the registration form for stock registration.

To move between registration fields in the display then Tab key or Enter key can be used.

The invoice can be registered without using mouse click.

When registering a purchase invoice it hsould be done in the following order:

- Upper header

- Lower header

- Lines

- Cost line (if included)

- Select "Update costs on invoice lines"

- Select "Register in stock and book"

Header on purchase invoice

Supplier number/name

Suppliers can be searched both by ssn/number or name.

Invoice number

The number registered on the purchase invoice. The system takes care of that the same invoice is not registered more than once by comparing the supplier, invoice number and invoice date.

Description

Possible to enter some description but not necessary.

Invoice date

The date of issue. This date becomes by default the stock transaction date in the header of the product lines registration but can be changed if requested.

Currency

By default the currency registered for the supplier in the customer record is selected but can also be changed in the registration. The exchange rate selected is by default the official exchange rate on the invoice date but can also be changed in registration.

Total invoice amount excl. vat

Total amount on the invoice excl. vat.

Vat on invoice

Total vat on the invoice.

Total costs on invoice excl. vat

Total cost registered on the invoice i.e. part of the invoice total amount.

Total external costs in ISK excl. vat

Total cost that are not part of the invoice but should have impact on the cost price of the products on the invoice. This could be separate invoice from third part company for some transport. This cost is always registered in the currency that the company is using in its account system i.e. ISK for Icelandic companies.

Total quantity

Total quantity on the invoice lines. This is necessary to be able to split costs proportionally by quantity. Total quantity is also used for error checking.

Costs split on item lines by quantity

Two different methods can be used to split costs on invoice lines. One is by splitting by quantity on invoice lines. Splitting by quantity is done by calculating the percent of the quantity on then invoice line as part of total quantity. The other method is done by calculating the percent of the purchase price as part of the total invoice amount.

Selecting between those two methods is done by clicking on Settings.

Product lines

Registration of invoice product lines. To move between fields both Tab key and Enter key can be used.

If company has subscription for the account system the column Account key is added to the registration form. If more than one stock place is registered for the company a column for selecting stock is added.

If company is using dimensions in the account system, defined here Admin>File administration>Dimensions control columns for the defined dimensions are added.

If product is not defined as being part of the stock system the image ![]() will appear in the end of the line and if clicked the product will be defined as part of the stock system.

will appear in the end of the line and if clicked the product will be defined as part of the stock system.

Product

Products can be selected by entering part of the product number, product name, supplier product number or barcode.

Cost price

When registering an invoice line, the system calculates new cost price using purchase unit price and the costs splitted on invoice lines as described before.

If the cost price changes more than defined percent defined under Settings the system warns about it by showing the field cost price as bold and in red color and then the older cost price is shown if the mouse pointer is hovered over the new cost price. The sale price for the product is never changed automatically using the new cost price. After registering the invoice line, the old sale price is shown as well as markup percent and contribution percent using the old sale price and new cost price.

Discount per unit

As discount both amount of discount or percent can be registered. Discount percent can be registered by adding % behind registered number. Registering discount percent can be convenient if the discount amount is not registered on each line only as total on the invoice. If discount is only registered as total on the invoice known percent can be registered on each invoice line and then the calculated total can be compared with the total discount on the invoice.

Price calculation

To change sale price the invoice is clicked and then the image ![]() is clicked. The display here down under is shown where the sale price can be changed in different ways i.e. change directly the sale price excluding or including vat, change markup amount or markup percent. When sale price is changed new contribution % is shown. Clicking Update prices updates those changes in the product table.

is clicked. The display here down under is shown where the sale price can be changed in different ways i.e. change directly the sale price excluding or including vat, change markup amount or markup percent. When sale price is changed new contribution % is shown. Clicking Update prices updates those changes in the product table.

eCommerce invoices registered in stock

When eCommerce invoices are received and booked they are automatically imported to purchase registration. In purchase registration all eCommerce invoices which have not already been updated to stock can be viewed and copied to registration for stock update.

If supplier item number is registered for product in Regla the eCommerce invoices should mostly be ready for stock update. If supplier item number not registered each product line has to be clicked on and product registered.

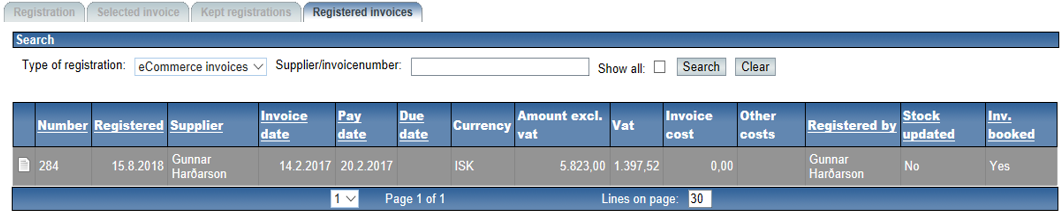

eCommerce invoices are viewed by clicking on the tab Registered invoices and then selecting eCommerce Invoice as shown here.

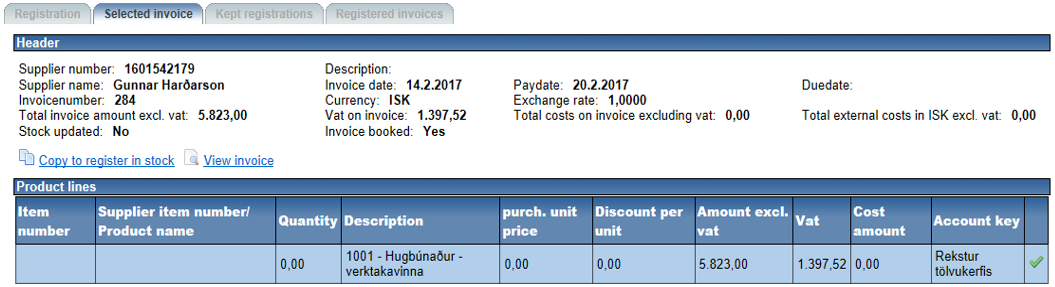

Invoices are selected by clicking on the image in the first column. After selecting an invoice this page is displayed:

The invoice is then selected for stock registration by clicking on Copy to register to stock. By clicking on View invoice display of the eCommerce invoice is shown. After the invoice has been copied to the registration form display of the invoice can also bee shown by clicking on View invoice in the registration form.

Action buttons

Most of the action buttons can be activated by keyboard shortcut keys.

The shortcut keys can be shown by hovering the mouse pointer over the action buttons.

Update costs on invoice lines

Invoice lines costs is calculated immediately when registering the invoice line if totals have been registered in the invoice header.

The invoice line costs can also be calculated after invoice lines registration by selecting this action button.

Register in stock

If company has subscription for both accounting system and sale/stock system but anyway only stock registration should be performed this action is selected in stead of action Register in stock and book. The reason for this need could i.e. be that real invoice has not been received only delivery note and then later when the invoice is received the action Book in account system can be selected. Invoice could also have been received as eCommerce invoice and already booked.

eCommerce invoices are automatically imported to purchase registration and can be selected from there and copied for stock registration.

Book in account system

If company has subscription for both accounting system and sale/stock system but anyway only account booking should be performed this action is selected instead of Register in stock and book. The reason for this need could i.e. be that stock registration has already been done using delivery note as mentioned her above.

Error check

The error check compares total calculated sums of registered invoice lines against registered total in the invoice header.

This error checking is also performed when registering in stock and/or booking in account system and actions not performed if totals do not match.

Keep registration

If registration is not finished for some reason and needed to keep it for later finishing this action is selected. As many registrations as needed can be kept.

Kept registrations can later be found by clicking on the tab Kept registrations and selected from there into registration and finished. If the registration is leaved for short time and no other registration in between there is no need to keep the registration before leaving because it will appear as you leaved it when you turn back to registration.

Register in stock and book

The invoice will be registered both in stock system and accounting system if no error found. If company has not subscription for both systems the name of the action button will change accordingly and only one of the systems will be registered/booked into.

Cancel registration

Here you cancel the registration of the invoice and the form will be ready for new registration.

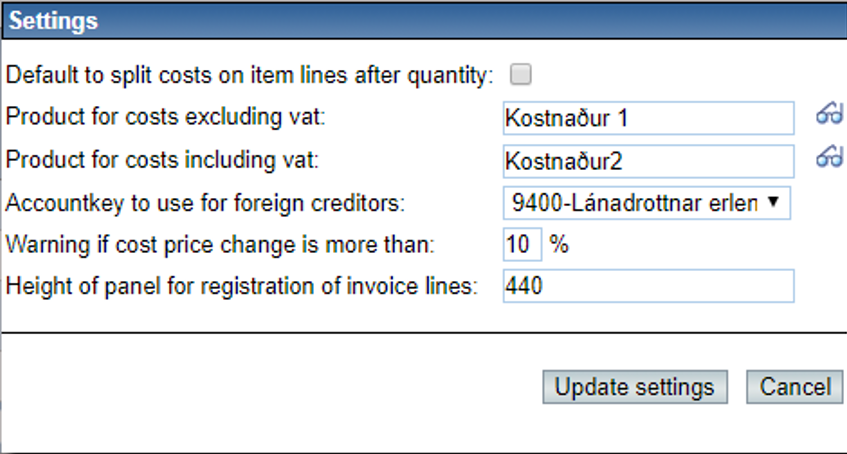

Settings

Here some settings that are registered which control the working of purchase registration.

Default to split costs on item lines after quantity

If checked costs are split proportionally after quantity on invoice lines.

If not checked then purchase unit price is used instead of quantity.

When the purchase invoice is registered you can always choose between those two methods in the registration process.

Product for costs excluding/including vat

Products which should be used when registering costs than are part of the invoice.

Account key to use for foreign creditors

The account key used for foreign creditors. Some companies want to distinguish between domestic and foreign creditors in booking but other companies want to use the same account key.

Warning if costs price change is more than the decided %

If cost price of product is changing from older cost price and the difference is more than defined percent here the system will warn about this by showing then new cost price as bold and in red, and then by hovering over the new cost price the older cost price can be viewed.

Height of panel for registration of invoice lines

Height in pixels for the area used for registering invoice lines before showing a scroll bar.